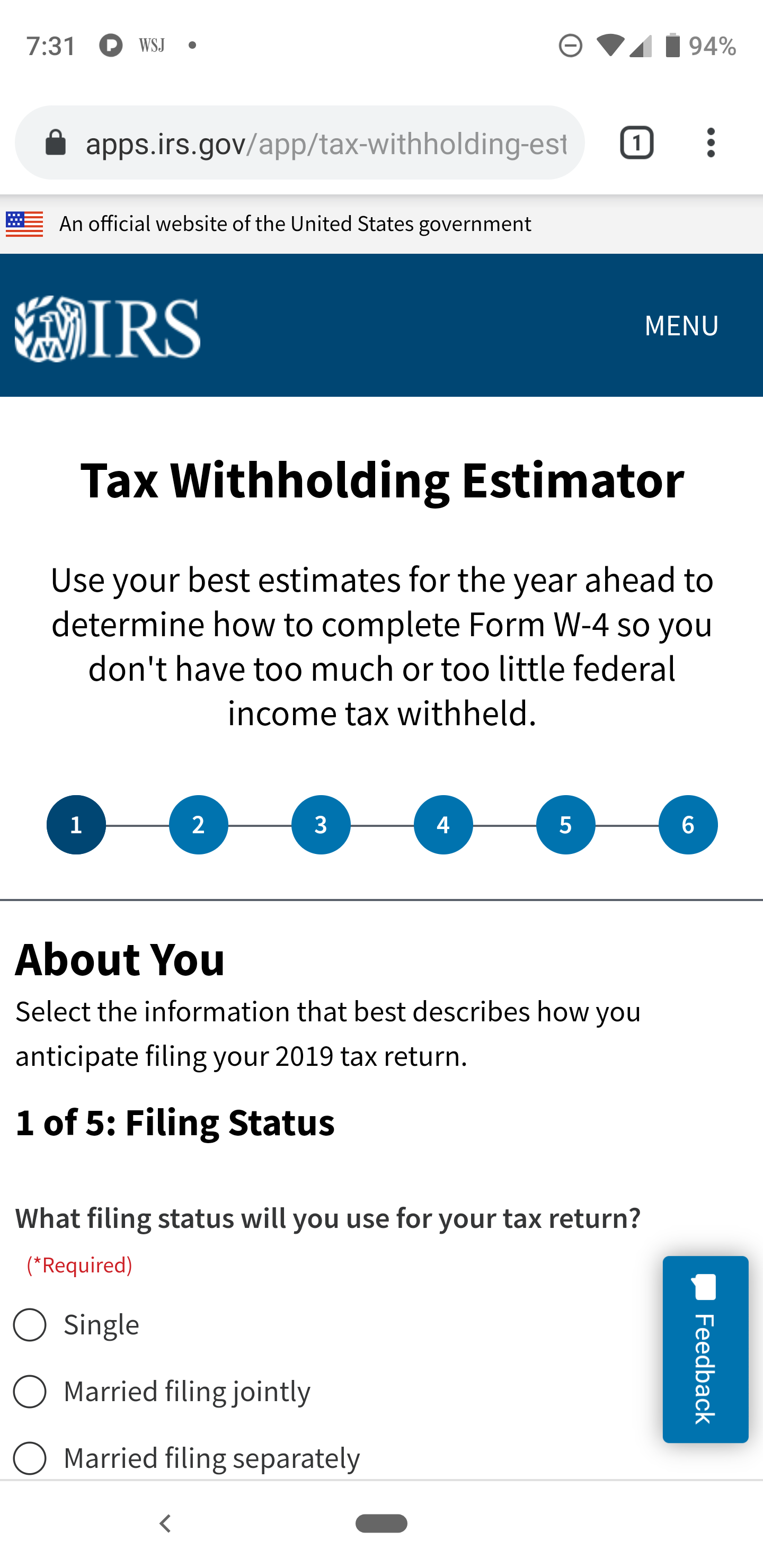

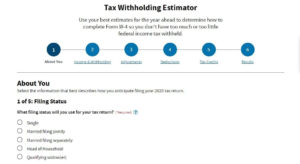

IRS Withholding Estimator – The tax withholding estimator 2021 permits you to compute the federal income tax withholding. This tax calculator helps you establish how much withholding allowance or added withholding has to be noted with your W4 Form. This estimator could be used by nearly all taxpayers. However, should your tax scenario has a lot more complexity than common, you may additionally need to use the instructions provided by IRS in Pub 505.

What’s the Tax Withholding Estimator?

An online tool called a tax calculator, which calculated the withholding allowances quantity for IRS, was obtainable. In 2019, however, it has been replaced by the IRS Withholding Estimator. IRS encourages you to definitely make use of the estimator tool for a “paycheck checkup” – this assists to ensure the tax withheld from the paycheck is right.

How is Tax Withholding Calculated?

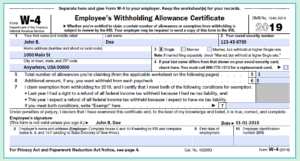

Employers withhold income tax from employees to send for the IRS. The W2 Form, Wage and Tax Assertion will replicate the amount of wages paid and the tax withheld. This assertion is sent to workers in the stop of the year.

How does the Tax Withholding Estimator perform?

You can modify the federal and state withholding taxes by getting in touch with the human resources department from the organization and publishing a Form W4. Some organizations enable workers to make changes online. Other people favor it to become completed in person. Once the employer has received details on W4 Form from employees, you’ll be able to estimate your withholding tax.

In such occasions, a IRS Withholding Estimator is particularly helpful. You can also follow the directions on the form, or discuss in your accountant about this.

You are going to first require to enter the needed info, this kind of as your income and preferred tax withholding allowances, should you utilize the estimator tool. Right after you’ve provided the small print, the tool will calculate the advised quantity to withhold.

It’s a smart idea to calculate the withholding tax quantity when tax submitting season ends, which can be several months just before Tax Day. Also, every time there are significant changes within your life that might have an effect on your taxes, it really is a good idea to do so.

IRS Tax Withholding Estimator 2021

Here’s the hyperlink to IRS Withholding Estimator:

- Tax Withholding Estimator – https://apps.irs.gov/app/tax-withholding-estimator

- Salary Calculator – https://www.calculator.net/salary-calculator.html

- Paycheck Calculator – https://www.adp.com/resources/tools/calculators/salary-paycheck-calculator.aspx

- Roth IRA Calculator – https://www.bankrate.com/retirement/calculators/roth-ira-plan-calculator/

Related For IRS Withholding Estimator

[show-list showpost=5 category=”tax-withholding-estimator” sort=rsort]