TAX WITHHOLDING ESTIMATOR 2021 IS A TOOL PROVIDED ON IRS WEBSITE. HERE IS WHAT THE ESTIMATOR IS, HOW IT WORKS WHEN TO USE IT, AND HOW TO USE THE TOOL

Tax withholding estimator 2021 is a tool that helps you to estimate the amount of federal income tax withholding. This estimator assists you to determine the amount of withholding allowance and extra withholding which must be reported on the W4 Form. It can be used by nearly all taxpayers, but if your tax situation is more complex than the average, then you may also use instructions issued by IRS inside Publication 505.

What Is Tax Withholding Estimator?

IRS used to have an online tool call a tax withholding calculator that calculates withholding allowances amount. However, in 2019, it is being replaced by a redesigned tool called Tax Withholding Estimator. It is encouraged by IRS to use the estimator tool to conduct a ‘paycheck checkup’ – a process that helps you make sure the tax withheld from your paycheck has the correct amount.

Here are a couple of reasons why you should check the withholding amount:

- To help prevent the amount of your tax withheld, which may cause you to face tax penalty or bill during the tax season of the following year.

- To help assess if you prefer a lesser amount of tax withheld in advance, so you are able to receive more of the paycheck and gain a lesser tax refund.

How Tax Withholding Is Determined?

In general, the employers withhold their employees’ income tax from their paycheck, to send it to IRS on their account. The amounts of paid wages and tax withheld is going to be reflected on the W2 Form or Wage and Tax Statement that sent to the employees at the year’s end.

The tax withheld amount is determined by:

- How much income that’s being earned

- The information provided by employees on the W4 Form or Employee’s Withholding Allowance Certificate:

- Filing status (whether they pay taxes as a single or married person)

- Claimed amount of withholding allowances (more claimed allowance means a lesser amount of tax withheld)

- Additional withholding (the requested additional amount of tax withholding by an employee from their paycheck)

How Does Tax Withholding Estimator Work?

Adjusting the amount of federal and state withholding tax can be done by reaching the company’s human resource department and submitting a new Form of W4. There are companies that let their employees make adjustments online, while some may prefer for it to be done in person. After the employer or company has information that’s provided in W4 Form, your withholding tax can be estimated.

Using a tax withholding estimator is especially helpful in times like this. However, alternatively, you may follow the guidelines provided within the form or discuss it with the accountant.

If you choose to use the estimator tool, then you will need to input required information such as your income and your preferred tax withholding allowances. Then, the tool will proceed with the provided details and inform you the amount of recommended amount to be withheld.

Generally, it will be wise to estimate the amount of withholding tax when the tax filing season is up, several months before Tax Day, and whenever you experience a major change in your life that may affect your taxes.

Who Can Use The Withholding Estimator?

As mentioned briefly prior, the estimator for tax withholding can be used by almost all taxpayers, while more complicated situations may require you to use Pub. 505 instructions. Here is the list of people that might find Tax withholding estimator 2021 beneficial:

• Employers who use the tool to look up tax withholding tables.

• Employees who use the tool to plan their taxes and see the future projection of their tax withholdings.

• Tax professionals who want to assist their clients to plan taxes or to test new software related to tax.

Regardless of how practical the online estimator is, keep a note that it may show different amounts of tax withholding that’s calculated by check stubs of taxpayers, such as when you use the tax table’s method instead of a formula of tax withholding.

It is important to check the information inputted in the estimator and perform recalculation if there is indeed a discrepancy in the amount. It is also recommended to cross-check between the employer and employee to ensure that the amount of tax withheld is accurate.

When You Should Use Withholding Estimator?

It is always recommended to use a tax withholding estimator by IRS to conduct paycheck checkups. You also may need to check your tax withholding when experiencing major life changes. Here are when it might be in your best interest to use the tool:

- During the early tax year

- When there is a change of law regarding tax

- When there is a life change event, such as:

- Marriage, divorce, childbirth or child adoption, retirement, bankruptcy filing, home purchase.

- Earned income when you or your spouse starts a new job or stops the current one, or starts a second job or stop doing it.

- Non-withheld taxable income which includes interest and dividends, self-employment, capital gains, distributions of IRA and Roth IRA.

- Tax credits or itemized deductions preference which includes charity, medical spending, child tax credit, education credit, and others.

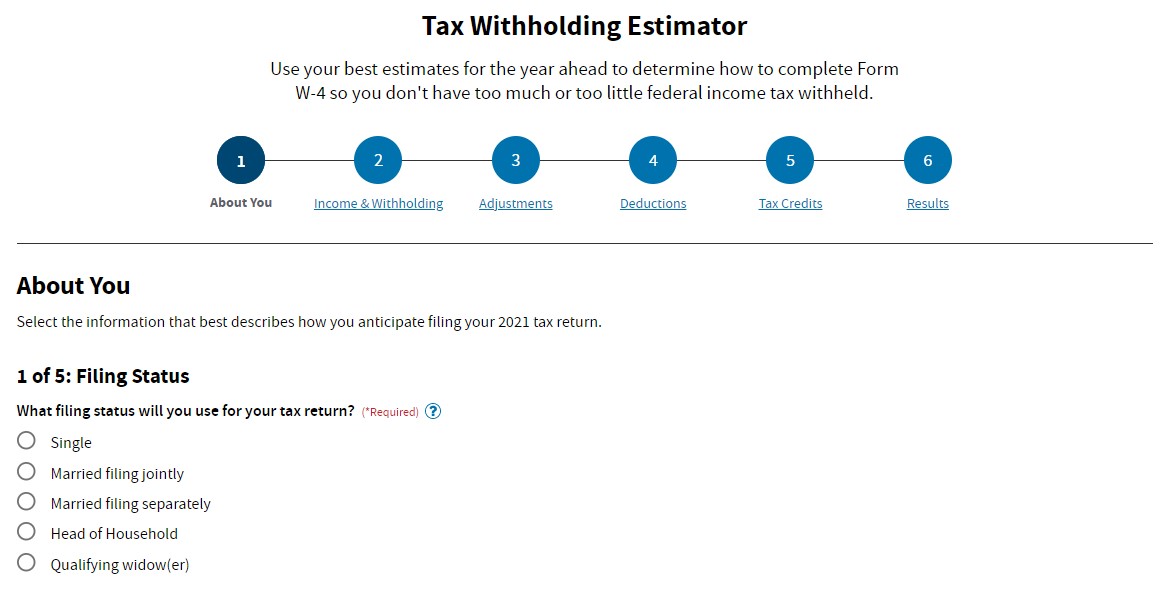

How to Use IRS Tax Withholding Estimator?

Tax withholding estimator 2021 will require you to estimate your income values and other things that may affect the taxes. Here are the steps to take if you want to use the estimator tool:

- Collect your latest pay stubs if you are an employee.

- Prepare your latest Form 1040 or Individual Income Tax Return document if you are the employer.

- Input the details according to the instructed steps by the IRS tax withholding estimator.

The more accurate the information you provide, the more accurate the result given by the tool as well. Also keep in mind no withholding estimator tool – whether it is from IRS or other third parties – that needs you to provide sensitive personal information, such as your name, your address, or your Social Security number.

Here is the link of Tax Withholding Estimator 2021: https://apps.irs.gov/app/tax-withholding-estimator

Tax Withholding Estimator 2020 VS 2021

As Tax withholding estimator 2021 is merely a calculation tool, its changes follow tax policy adjustments. Below are some of the unique changes that will affect how your tax filing season goes:

Individual Income Tax Returns Adjustments

There are two economic impact payments sent by the IRS and Treasury Department, which are also referred to as stimulus payments, as part of coronavirus relief packages. The payments are technically advanced tax credits provided to individuals based on adjusted gross income (AGI). It’s also possible to receive additional payment as a refundable tax credit.

Tax Exclusion For The Benefits Of Unemployment Insurance

As there is an increase in the amount of unemployment during 2020, lawmakers decide to increase the amount of unemployment insurance (UI) benefits payment. It may result in an unexpected tax bill during tax season, so the amount of UI benefits withheld tax needs to be provided correctly.

Individual Tax Refunds Adjustments

Currently, the amount of tax refunds for the upcoming tax year is still uncertain. However, judging from the data trends, it tends to move higher compared to the previous tax season.

IRS Pub. 505: Tax Withholding and Estimated Tax 2021 Download

Loading...

Loading...

Frequently Asked Questions (FAQ) & Answers

What Is A Tax Withholding Estimator?

Tax Withholding Estimator is an online tool that’s provided by the IRS to allow taxpayers to conduct paycheck checkups and ensure that the amount of tax withheld from their paychecks is correct.

How Do I Calculate My Paycheck Withholdings?

You simply need to input the required information by the tool. There is also a step-by-step tutorial video that’s available on the official IRS website that you may use as guidance to use the estimator.

What Percentage Is Taken Out For Federal Taxes?

There are seven tax rates of an individual’s federal income tax, which range from 10% to 37%. Your assigned tax rate depends on your earned income that applies to the specific tax bracket range.

What Is The Minimum Federal Tax Withholding?

The tax withholding amount from employees’ paychecks has no threshold. However, there is a threshold amount of income that must be reached for an employee to be eligible to file their tax returns.

Is It Better To Claim 1 Or 0 On Your Taxes?

It depends. If you prefer to receive more money during your paycheck, then you may claim 1 withholding allowance. Meanwhile, if you prefer to receive more tax refunds, then it is best to claim 0 withholding allowance.

What Does Claiming 2 On Taxes Mean?

The rule of thumb is the more withholding allowance is claimed, the less tax withholding that’s being taken from your paycheck. If you claim 2 withholding allowances, then there’s less amount of tax withheld and less amount of tax refund by the end of tax year.

How Do I Get Less Tax Taken Out Of My Paycheck In 2020?

You need to provide new amounts of tax withholding. If you want to decrease the tax that’s taken from your paycheck, then lower the amount of withholding on your W4 form and vice versa.

Tax withholding estimator 2021 provides an easier and more practical way to estimate your tax withholding, assuming that you already have all the required information details prepared. After you have provided all the details and execute the process, this convenient online tool will give your recommended amount of tax withholding and give you a reference on what to do next.

Related For Tax Withholding Estimator 2021

[show-list showpost=10 category=”tax-withholding-estimator” sort=sort]