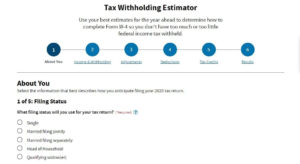

Income And Tax Calculator – The tax withholding estimator 2021 permits you to calculate the federal income tax withholding. This tax calculator aids you identify simply how much withholding allowance or additional withholding should be noted in your W4 Form. This estimator may be used by nearly all taxpayers. However, should your tax scenario has a lot more complexity than typical, you might also wish to make use of the guidelines supplied by IRS in Publication 505.

What’s the Tax Withholding Estimator?

An online tool called a tax calculator, which calculated the withholding allowances sum for IRS, was obtainable. In 2019, nonetheless, it’s been changed by the Income And Tax Calculator. IRS encourages you to utilize the estimator tool for a “paycheck checkup” – this helps to make certain which the tax withheld from the paycheck is correct.

How is Tax Withholding Calculated?

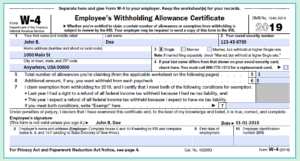

Employers withhold income tax from employees to send to the IRS. The W2 Form, Wage and Tax Assertion will mirror the amount of wages compensated and the tax withheld. This assertion is distributed to workers in the end of the year.

How does the Tax Withholding Estimator perform?

You’ll be able to adjust the federal and state withholding taxes by getting in contact with the human resources department from the company and distributing a Form W4. Some companies permit workers to create changes online. Others favor it to become done in individual. Once the employer has received details on W4 Form from workers, you are able to estimate your withholding tax.

In this sort of instances, a Income And Tax Calculator is especially helpful. You may also follow the directions on the form, or talk for your accountant about this.

You are going to first want to enter the needed info, such as your income and desired tax withholding allowances, in the event you use the estimator tool. Following you’ve got supplied the small print, the tool will calculate the suggested sum to withhold.

It is a smart idea to calculate the withholding tax quantity when tax submitting season finishes, which can be several months prior to Tax Day. Also, whenever you will find main changes in your life that may impact your taxes, it’s a good idea to take action.

IRS Tax Withholding Estimator 2021

Here is the hyperlink to Income And Tax Calculator:

- Tax Withholding Estimator – https://apps.irs.gov/app/tax-withholding-estimator

- Salary Calculator – https://www.calculator.net/salary-calculator.html

- Paycheck Calculator – https://www.adp.com/resources/tools/calculators/salary-paycheck-calculator.aspx

- Roth IRA Calculator – https://www.bankrate.com/retirement/calculators/roth-ira-plan-calculator/

Related For Income And Tax Calculator

[show-list showpost=5 category=”tax-withholding-estimator” sort=rsort]