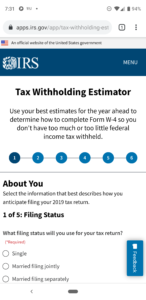

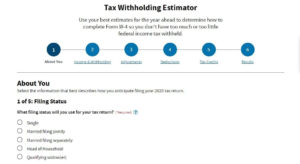

Federal Withholding Calculation 2021 – The tax withholding estimator 2021 allows you to determine the federal income tax withholding. This tax calculator assists you establish how much withholding allowance or additional withholding must be documented with your W4 Form. This estimator can be utilized by nearly all taxpayers. Nonetheless, if your tax scenario has more complexity than average, you may also wish to use the guidelines offered by IRS in Pub 505.

What’s the Tax Withholding Estimator?

An online tool known as a tax calculator, which calculated the withholding allowances quantity for IRS, was obtainable. In 2019, nonetheless, it has been changed through the Federal Withholding Calculation 2021. IRS encourages you to make use of the estimator tool to get a “paycheck checkup” – this helps to make certain which the tax withheld in the paycheck is correct.

How is Tax Withholding Calculated?

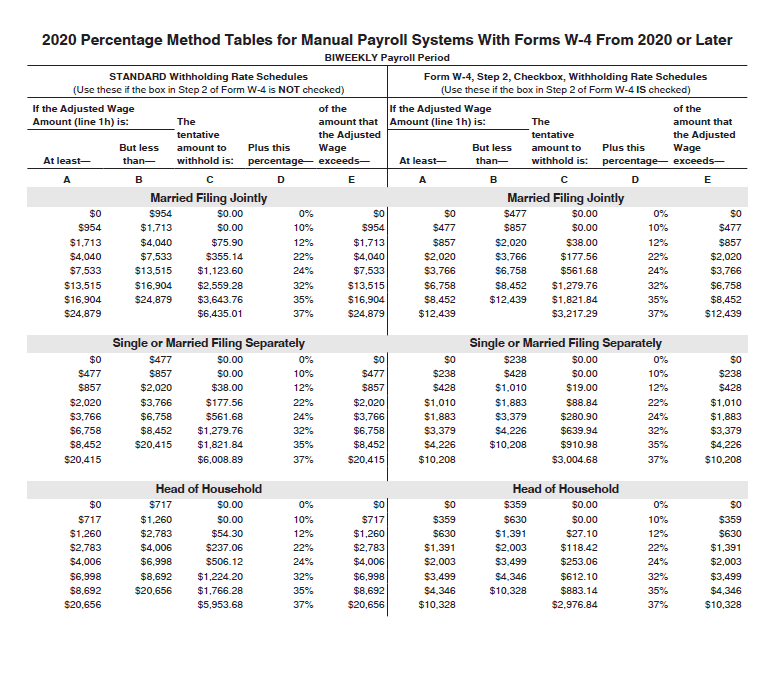

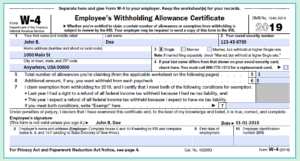

Employers withhold income tax from workers to send to the IRS. The W2 Form, Wage and Tax Assertion will mirror the quantity of wages paid out and the tax withheld. This statement is sent to staff in the stop from the year.

How does the Tax Withholding Estimator function?

You’ll be able to adjust the federal and state withholding taxes by getting in touch with the human resources department in the company and distributing a Form W4. Some businesses allow workers to create changes online. Other people choose it for being completed in individual. Once the employer has obtained information on W4 Form from workers, you are able to estimate your withholding tax.

In this sort of times, a Federal Withholding Calculation 2021 is particularly helpful. You can also stick to the directions around the form, or talk to your accountant about it.

You are going to initial require to enter the needed info, such as your income and preferred tax withholding allowances, in the event you utilize the estimator tool. After you’ve provided the details, the tool will compute the advised quantity to withhold.

It’s a good idea to calculate the withholding tax quantity when tax filing season ends, which may be several months prior to Tax Day. Also, every time there are significant changes within your life that may affect your taxes, it’s a good idea to do so.

IRS Tax Withholding Estimator 2021

Here is the website link to Federal Withholding Calculation 2021:

- Tax Withholding Estimator – https://apps.irs.gov/app/tax-withholding-estimator

- Salary Calculator – https://www.calculator.net/salary-calculator.html

- Paycheck Calculator – https://www.adp.com/resources/tools/calculators/salary-paycheck-calculator.aspx

- Roth IRA Calculator – https://www.bankrate.com/retirement/calculators/roth-ira-plan-calculator/

Related For Federal Withholding Calculation 2021

[show-list showpost=5 category=”tax-withholding-estimator” sort=rsort]