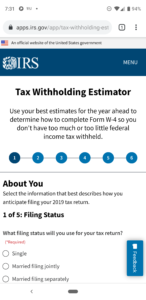

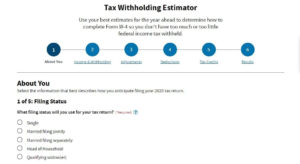

Federal Tax Withholding 2021 – The tax withholding estimator 2021 allows you to determine the federal income tax withholding. This tax calculator aids you establish just how much withholding allowance or additional withholding should be reported in your W4 Form. This estimator could be utilized by virtually all taxpayers. Nonetheless, if your tax circumstance has much more complexity than typical, you might also need to use the guidelines offered by IRS in Publication 505.

What’s the Tax Withholding Estimator?

An online tool called a tax calculator, which calculated the withholding allowances amount for IRS, was available. In 2019, however, it has been replaced by the Federal Tax Withholding 2021. IRS encourages you to make use of the estimator tool to get a “paycheck checkup” – this aids to make sure the tax withheld from the paycheck is right.

How is Tax Withholding Calculated?

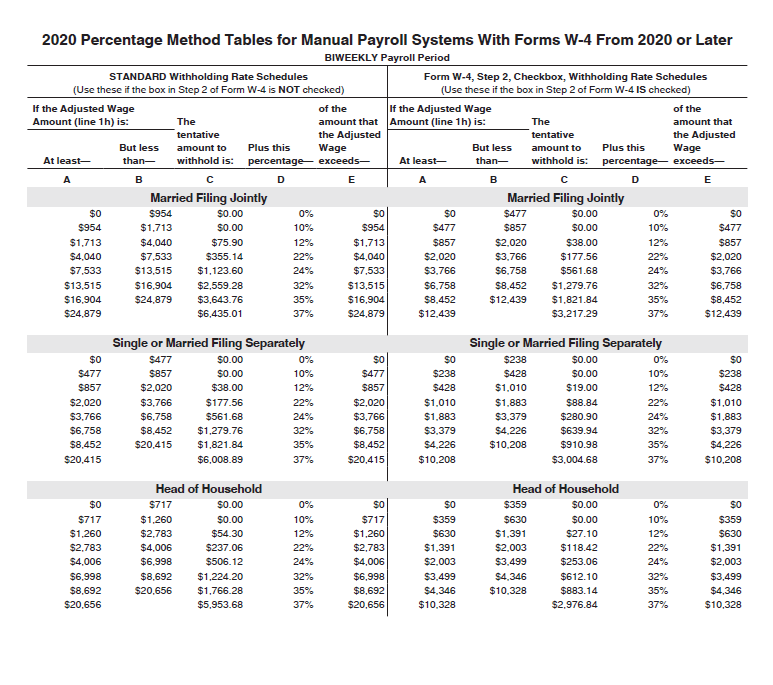

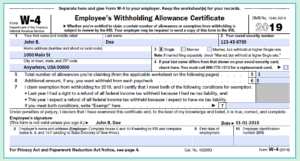

Employers withhold income tax from employees to send for the IRS. The W2 Form, Wage and Tax Statement will reflect the quantity of wages compensated and the tax withheld. This assertion is distributed to employees on the finish in the year.

How does the Tax Withholding Estimator function?

You’ll be able to modify the federal and state withholding taxes by getting in contact with the human resources department of the organization and publishing a Form W4. Some businesses permit staff to make changes online. Others favor it for being done in individual. When the employer has received information on W4 Form from workers, you’ll be able to estimate your withholding tax.

In this sort of times, a Federal Tax Withholding 2021 is especially helpful. You can even adhere to the guidelines on the form, or speak to your accountant about this.

You are going to first require to enter the required details, such as your income and desired tax withholding allowances, if you utilize the estimator tool. Following you’ve offered the small print, the tool will calculate the advised sum to withhold.

It really is a smart idea to compute the withholding tax amount when tax submitting season ends, which may be numerous months prior to Tax Day. Also, anytime you will find main changes within your lifestyle that could have an effect on your taxes, it’s advisable to do so.

IRS Tax Withholding Estimator 2021

Here’s the link to Federal Tax Withholding 2021:

- Tax Withholding Estimator – https://apps.irs.gov/app/tax-withholding-estimator

- Salary Calculator – https://www.calculator.net/salary-calculator.html

- Paycheck Calculator – https://www.adp.com/resources/tools/calculators/salary-paycheck-calculator.aspx

- Roth IRA Calculator – https://www.bankrate.com/retirement/calculators/roth-ira-plan-calculator/

Related For Federal Tax Withholding 2021

[show-list showpost=5 category=”tax-withholding-estimator” sort=rsort]