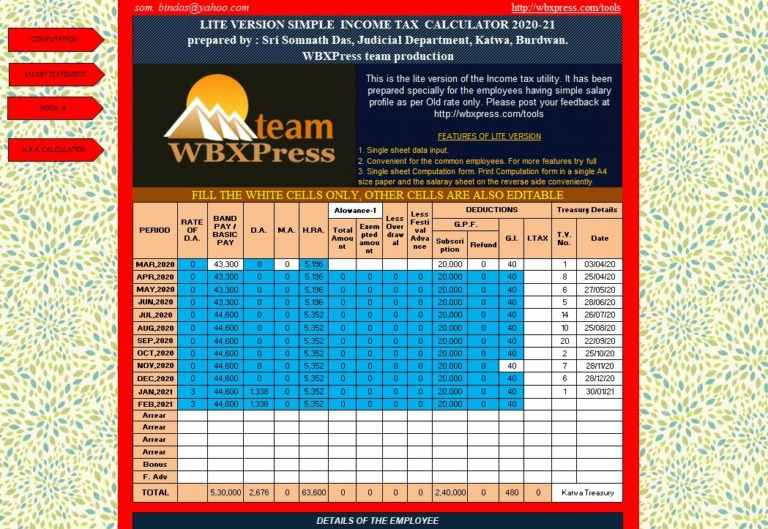

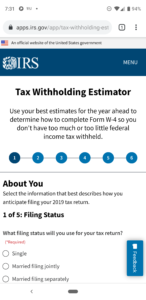

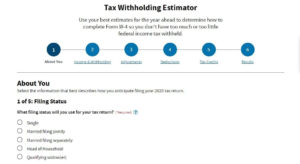

Simple Tax Calculator – The tax withholding estimator 2021 allows you to calculate the federal income tax withholding. This tax calculator helps you establish how much withholding allowance or extra withholding must be documented in your W4 Form. This estimator can be utilized by almost all taxpayers. Nevertheless, in case your tax circumstance has a lot more complexity than common, you may additionally need to utilize the directions provided by IRS in Publication 505.

What’s the Tax Withholding Estimator?

An online tool referred to as a tax calculator, which calculated the withholding allowances sum for IRS, was accessible. In 2019, nevertheless, it’s been replaced through the Simple Tax Calculator. IRS encourages you to use the estimator tool to get a “paycheck checkup” – this assists to ensure which the tax withheld in the paycheck is appropriate.

How is Tax Withholding Calculated?

Employers withhold income tax from workers to send to the IRS. The W2 Form, Wage and Tax Assertion will reflect the quantity of wages paid and the tax withheld. This statement is distributed to employees on the finish in the year.

How can the Tax Withholding Estimator work?

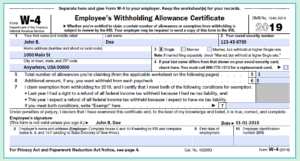

You’ll be able to alter the federal and state withholding taxes by contacting the human resources department of the organization and submitting a Form W4. Some companies allow workers to make changes online. Other individuals prefer it to be completed in particular person. Once the employer has acquired details on W4 Form from employees, you’ll be able to estimate your withholding tax.

In such instances, a Simple Tax Calculator is very beneficial. You can also stick to the guidelines on the form, or talk for your accountant about this.

You will very first require to enter the required info, this sort of as your income and desired tax withholding allowances, if you use the estimator tool. Right after you have supplied the details, the tool will compute the suggested sum to withhold.

It is a good idea to compute the withholding tax amount when tax submitting season finishes, which may be numerous months just before Tax Day. Also, every time you will find major changes inside your existence that could impact your taxes, it’s a good idea to take action.

IRS Tax Withholding Estimator 2021

This is the website link to Simple Tax Calculator:

- Tax Withholding Estimator – https://apps.irs.gov/app/tax-withholding-estimator

- Salary Calculator – https://www.calculator.net/salary-calculator.html

- Paycheck Calculator – https://www.adp.com/resources/tools/calculators/salary-paycheck-calculator.aspx

- Roth IRA Calculator – https://www.bankrate.com/retirement/calculators/roth-ira-plan-calculator/

Related For Simple Tax Calculator

[show-list showpost=5 category=”tax-withholding-estimator” sort=rsort]